By now you may or may not have applied for your visa for Canada. Whether you intend to live and work on a temporary basis or immigrate to Canada, you’re going to need a solid budget plan for when you first arrive in Canada.

The last thing that you want to get to Canada and you end up spending most of your money on unforeseen costs. In this article, we’ll take a look at some of the things that you ideally should be planning for as a newcomer in Canada.

Fast Budget Tips

- Differentiate Between Needs and Wants

- Find the Right Bank for Your Personal Needs

- Build a Solid Credit Score

- Consider Investment Opportunities

- Check if You Qualify for the Canada Child Benefit

- Stick to Your Plan

How Do You Budget in Canada?

Do Your Research Before You Arrive

As with any important life event, a little pre-planning goes a long way. Below are some of the things that you should consider before planning to move to Canada.

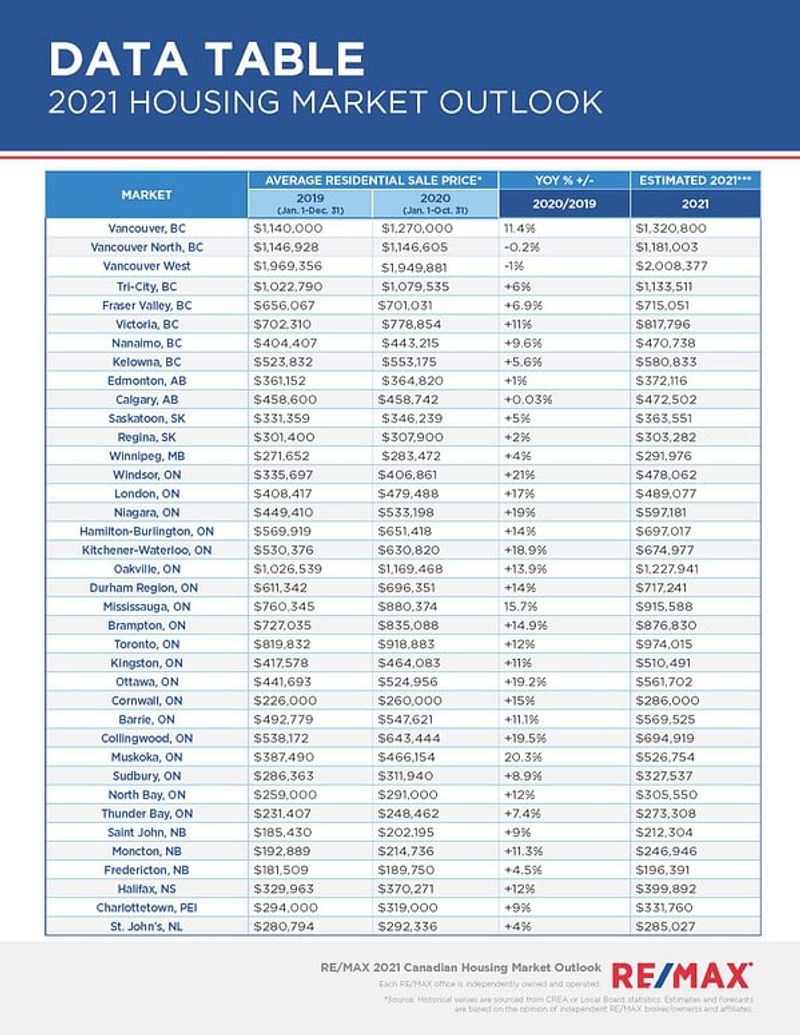

Rent or Buy

To rent or buy, that is the question. This is going to depend purely on your finances. According to Remax Canada, the cost of real estate is expected to increase between four and six percent in 2021. The cost of buying a house in Canada can range anywhere from $285,027 in St. John’s (Newfoundland & Labrador) to $1,320,800 in Vancouver (British Columbia). Below are some of the estimated costs of buying real estate in Canada.

Source:remax.ca

This being said, it seems that 2021 is not a buyers’ market but rather a renter’s.

If this does not fit into your current budget then renting is the way to go. Rentals.ca estimates in its 2021 Rent Report that the average rent in Canada in April 2021 was $1,675 per month, which is 9 percent down from last year and continues to decrease month by month. Depending on which province you choose to settle in, rent for a one-bedroom will cost anywhere from just $786 in Lloydminster (Alberta) to $1,935 in Vancouver (British Columbia). Below is a national overview of rental prices across Canada in 2021.

Source: rentals.ca

On average, British Columbia is the most expensive when it comes to housing costs whereas Newfoundland and Labrador are the cheapest in 2021.

Top Tip: Don’t forget to factor home insurance into your budget if you’re planning to be a homeowner. This is a requirement if you need to apply for a mortgage. There are three main types of coverage: basic, broad, and comprehensive. According to ratehub.ca, the average cost of home insurance is $960 per year but this, of course, varies depending on the type of home, location, and risk factors.

Car or Public Transportation?

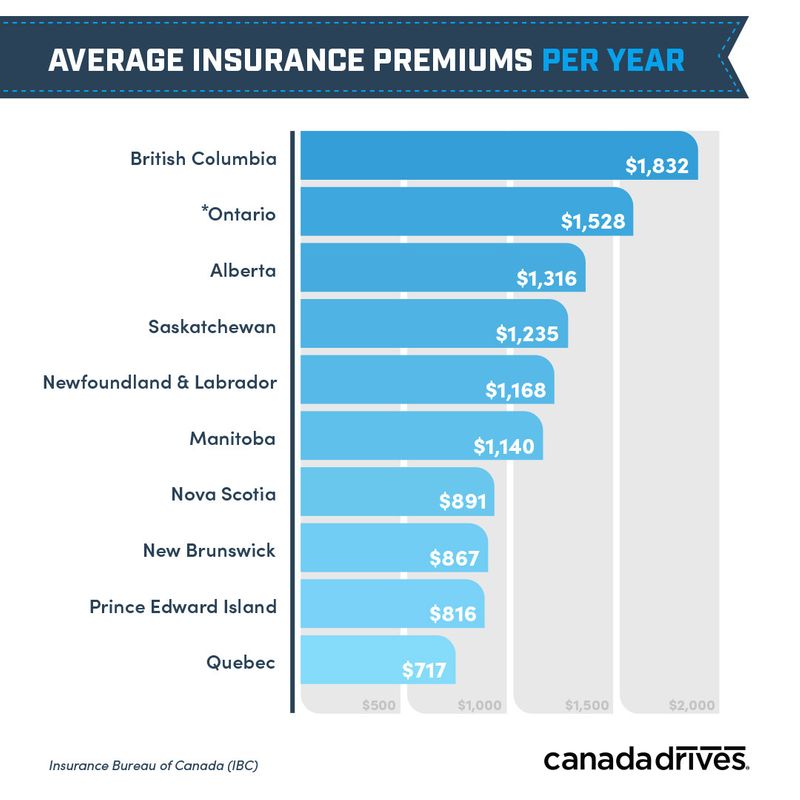

Canada has a safe and reliable transportation system. Newcomers in Canada can easily get around without a car. The average cost of a one-way ticket will cost you about $3.35 whereas a monthly pass is approximately $90. This may the more affordable option when first arriving in Canada as vehicle prices have increased in 2021 to an average of $40,000. Fuel or gas in Canada costs around $1.12 per litre. Car insurance is legally required in Canada and can range anywhere between $717 to $1,832 per year depending on which province or territory you are living in.

Below is a list of average annual insurance premiums by province based on data from Insurance Bureaus of Canada (IBC).

Source: canadadrives.ca

Additional Health Insurance?

Canada has free universal public healthcare coverage for all permanent residents and citizens, but what most people don’t know is that the coverage differs from province to province and in most cases will only take up to three months before you can use government health insurance.

Public healthcare or Medicare also does not cover additional costs such as prescription medication or eyeglasses, dental care, physiotherapy, or ambulance services. This is why it's a good idea to have healthcare to cover you for the first few months after arriving in Canada as well as private additional health insurance.

Below are the average costs of private health insurance in Canada:

| Average Cost of Health Insurance in Canada | |

|---|---|

| Type of Person Covered | Price CAD |

| Family | $157 |

| Single parent (father) | $78 |

| Single parent (mother) | $110 |

| Individual male | $47 |

| Individual female | $80 |

Food and Utilities Cost?

Basic utilities such as electricity, heating, cooling, water, and refuge could cost around $165 per month. Your internet cost will be anywhere between $36 to $93 per month (depending on the speed of your cable or ADSL as well as which province or territory you live in).

Food costs vary depending on your diet, where you live in Canada as well as your shopping and eating habits. If you like eating out at restaurants you can expect to pay between $7 and $50 for a meal. According to Statistics Canada, the average household spends around $214 per person on groceries.

Top Tip To save on shopping costs, buy in bulk and stock up on sale items. For the latest deals in Canada visit smartcanucks.ca.

Prepared for Unexpected Expenses?

As most people experienced the unexpected effects of COVID-19 in 2020, it is always a good idea to have a little bit of money kept aside for unexpected circumstances. For instance, if you immigrate to Canada through programs like the

If you intend on buying a home you may encounter maintenance costs (usually between three and five percent of the value of your home), as well as unexpected fuel or food price increases and the last thing you want to do is have absolutely no wiggle room when it comes to your budget.

Differentiate Between Wants and Needs

Now once arriving in a new country, it may be tempting to splurge a little but it is extremely important to separate what you absolutely need from what you want. For example, if buying all new furniture may not be what you need when you first get to Canada. Instead, opt for furnished accommodation and save up. If you can’t afford a new car, buy a pre-owned car or take public transportation. Every dollar you save will be worth it in the long run.

Draw Up a Realistic Budget

When preparing your budget it’s important to set realistic goals that you will be able to maintain. It’s important to keep track of your spending, especially while you are getting used to living in a new country. If you need help tracking your expenses there are plenty of apps that make budgeting both easy and efficient.

Top Tip: Make allowances for eating out for the first few days as you may not be cooking when you’ve just arrived.

Find the Right Bank for Your Personal Needs

Opening a bank account in Canada will be one of the first things that you’ll need to do once you arrive in Canada. It’s best to shop around and find out which bank offers the best value based on your specific needs. Canada has five major banks:

- Bank of Montreal (BMO);

- Scotiabank;

- Canadian Imperial Bank of Commerce (CIBC);

- Royal Bank of Canada (RBC); and

- Toronto-Dominion (TD) Bank.

When looking for a bank in Canada it’s important to consider certain factors, such as:

- Locations of branches and ATMs;

- Monthly fees (many banks offer free banking or Newcomer Packages);

- Additional fees;

- Monthly fees after the free period expires; and

- Unsecured credit card options (if applicable).

Below is a comparison of Canada’s five best banks for newcomers:

| Average Cost of Health Insurance in Canada | ||

|---|---|---|

| Bank | Features | Annual Fee |

| Scotiabank Start Right Program |

| $0 on Preferred Package valued at $203,40 |

| Bank of Montreal |

| $0 for a year with a $4,000 balance the Performance Plan |

| Canadian Imperial Bank of Commerce |

| $0 for a year |

| Royal Bank of Canada Newcomers Advantage |

| $0 for a year |

| Toronto-Dominion Chequing Account |

| $0 for the first 6 months with a minimum monthly balance of $4,000 |

Other popular smaller banks and credit unions include Tangerine and Simplii Financial.

Build a Solid Credit Score

When moving to Canada, you will need to build your credit score from scratch. It is extremely important to have a good rating as it could influence the likelihood of getting a job, loans, and even renting an apartment or owning a home

What is a Credit Score?

It is a number between 300 and 900 used to determine how creditworthy you are. The higher your score, the more likely it will be that you are successful in future applications for jobs in Canada as well as home loans, rentals, and mortgages.

How Do I Improve My Credit Score?

- Use a secure credit card and pay your monthly balance consistently

A secured credit card is a great option if you do not qualify for a regular credit card or unsecured credit card. A secured credit card works similarly to an unsecured credit card but you’ll need to make a deposit to match the size of your credit limit. Most of these cards offer low-interest rates and annual fees

Below is a list of credit cards that you may qualify for as a newcomer in Canada.

| Average Cost of Health Insurance in Canada | ||

|---|---|---|

| Credit Card | Features | Annual Fee |

| Refresh Financial Card |

| $12.95 + $3 per month maintenance fee |

| Home Trust Secured Visa |

| $0 ($59) |

| The Capital One Low Rate Guaranteed Mastercard |

| $79 |

| Capital One Guaranteed Secured Mastercard |

| $59 |

| RBC Visa Classic Low Rate Option |

| $20 |

- Use a Credit Building Tool

If you need help building your credit score, companies such as KOHO have credit-building tools which could help. And for just $7 per month, it might be worth your while checking out what they have to offer.

Consider Investment Opportunities

A great way to start investing in your future is to look at your investment options. To great options are Tax-free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs).

Tax-free Savings Accounts (TFSAs)

TFSAs allow you to invest your money long-term without having to pay taxes. One of the added bonuses, besides the compound interest, is that if you don’t reach your annual contribution limit you can make up for it in your second year! Your money will also be available to you whenever you need it however it’s better to leave it where it is if you can.

Registered Retirement Savings Plans (RRSPs)

RRSPs generally have higher contribution limits than TFSAs, however, the main difference is that you can contribute 18 percent of your income from any given year. Withdrawals from these accounts are however taxed. This is to eb=ncourage long-term investing and prepare you for retirement.

Familiarise Yourself With the Canadian Tax System

Income Tax - How Does it Work?

Canada’s tax system is graduated. This means that the more you earn, the more you will be taxed. Money earned is divided into income tax brackets with different tax rates. You will first be taxed at the rate of the lowest tax bracket and then pay the higher rate for each additional dollar.

For example, if you earn $1, you’ll be taxed 10 percent. On the second dollar, you’ll pay 20 percent and on the third dollar, you’ll pay 30 percent. You will, however, never pay 30 percent on $3. Instead, you will pay $0.60, which works out to about 20 percent.

You have to report your income to the Canadian Revenue Service (CRA) by filing a tax return. Employed people have to file their returns and pay their income tax by April 30. and Self-employed people have to pay their taxes by April 30 but have until June 15 to file their return.

All those working in Canada will have a Social Insurance Number (SIN), which you will need along with your T4 or final payslip when you file your tax return.

It is important to note that each province or territory has different tax rates and income brackets. Below is a breakdown of income tax rates by province/territory.

| Income Tax Rates in Canada | |

|---|---|

| Province/Territory | Tax Rate |

| Alberta |

|

| British Columbia |

|

| Manitoba |

|

| New Brunswick |

|

| Nova Scotia |

|

| Newfoundland & Labrador |

|

| Northwest Territories |

|

| Nunavut |

|

| Ontario |

|

| Prince Edward Island |

|

| Quebec |

|

| Saskatchewan |

|

| Yukon |

|

How Do You Pay Income Tax

Paying income tax in Canada be done online or via paper-based submission. Paying online is by far the most convenient route to take as you won’t have to stand in a queue at the bank. There are three ways that you can pay your income tax:

- Online Banking;

- Pay directly to CRA with a Debit Card through My Payment;

- Use a third-party service to pay with a credit card or Paypal.

It is important to file your return as you may be able to claim for certain expenses, such as:

- Medical

- Travel eg. monthly transit passes

- Business eg. rent, supplies, travel, etc.

Deductions could reduce your taxable income and therefore lower your tax rate.

You could also be eligible for certain payouts like:

- Child tax benefit;

- GST/HST credit; or

- Guaranteed income supplement.

Sales Tax in Canada

Sales tax or Goods and Services Tax (GST)/Harmonized Sales Tax (HST) is 0 percent on groceries in Canada, however, differs for other goods based on which province or territory you find yourself in.

- 5 percent in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon.

- 13 percent (HST) in Ontario; and

- 15 percent (HST) in New Brunswick. Newfoundland and Labrador, Nova Scotia, and Prince Edward Island.

Remember that in Canada the sales tax does not appear on the price of the item you are buying but will be added when you get to the point of sale.

Check if You Qualify for the Canada Child Benefit

The Canada Child Benefit (CCB) is a non-taxable monthly payment made to assist families with the cost of raising children who are under 18 years old. To be eligible for the CCB you need to meet the following criteria:

- Your child must live with you and be under 18 years old;

- You must be the primary caregiver;

- You must be a permanent resident of Canada;

- You or your spouse or common-law partner must be any of the following:

- a Canadian Citizen

- a permanent resident

- a protected person

- a temporary resident who has lived in Canada throughout the previous 18 months and has a valid permit in the 19th month other than one that states "does not confer status" or "does not confer temporary resident status.";

- an Indian as defined by the Indian Act.

The benefit is calculated based on the number of eligible children, their ages as well as your adjusted family net income.

Speak to Locals to Find the Best Deals

There are various ways that you can save money while living in Canada. Besides doing online research, the best way to find the best deals is to speak to the locals in your area. You’ll find that they often know where all the good deals are that often aren’t advertised online whether it’s from the local deli down the street or the family-owned restaurant that's been around for over 30 years.

Some grocery stores in Canada such as Walmart and The Real Canadian Superstore have a 10 percent price match or will match their competitors' prices. Many stores also offer coupons which could lead to great savings.